Hearth Tax 1666 and 1674

The Hearth Tax was introduced by Parliament in 1662 to fund the Royal Household of King Charles II. Each household was charged two shillings per hearth or stove annually, payable in two instalments: on Michaelmas (29 September) and Lady Day (25 March). Certain groups were exempt, including:

- Households exempt from Poor or Church Rates

- Tenants of property worth less than 20 shillings (£1) rent per year

- Owners of assets valued under £10

- Private ovens, furnaces, kilns, and blowing houses (smelters)

- Hospitals and almshouses with revenues below £100 per year

Before the advent of national censuses, these tax returns provide a rare window into population size, wealth, and housing conditions. The tax was unpopular and inconsistently enforced, and it was finally abolished in 1689 when William III and Mary II came to the throne. The most complete surviving records date from 1666 and 1674, and those for County Durham have been published by The British Record Society (Durham Hearth Tax, 2006). The tables in this article have been reproduced or calculated from this source.

County Durham Overview

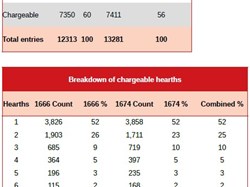

In 1666, Durham recorded 12,313 hearths; by 1674 the number had risen to 13,281- see table 1 below. However, 44% of these attracted no charge. Of those taxed, just over half were single-hearth dwellings, and another third had two or three hearths.

Researchers estimate the true figure of hearths was closer to 14,500 hearths, implying a County population of about 70,000.

Washington and Harraton in 1666

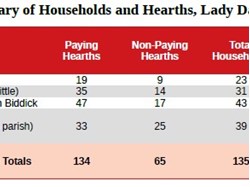

Applying Durham’s hearth-to-population ratio suggests the Parish of Washington and Harraton Manor, then part of the Parish of Chester le Street, together had about 700 inhabitants in 1666. This combination is the approximate extent of modern Washington.

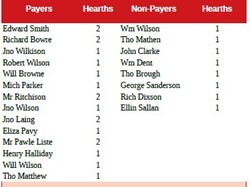

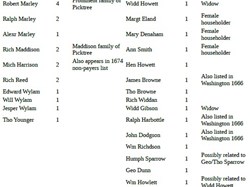

Table 2 show the number of hearths and households in the manors of Washington parish, plus the Harraton Manor in 1666. Tables 3 to 6 are lists of recorded names of payers and non-payers in Barmston, Usworth, Washington and Harraton respectively. Click in each to see the full tables. Note that the spellings of names are as recorded.

Seventy-eight per cent of all households had only a single hearth, including all the non-payers, - higher than the county average of 52% - reflecting Washington’s rural character. Notably, two householders (one in Washington, one in Usworth) were liable for 10 hearths each, and one in Harraton for nine.

The most frequent family name in Barmston - Table 3 was Wilson (4). Eliza Pavey and Ellen Sallan were the only female householders, most likely widows or daughters who had inherited from families without sons..

Table 4 shows William Lawson Esq owned the largest dwelling with 10 hearths in Usworth. Right up to the 19th century the Lawsons owned hundreds of acres in both Little and Great Usworth, so might have lived in either manor house, located where Manor Road, Concord is today or the site of Usworth Place at Springwell, built 90 years later by William Peareth.

The Mr James, owner of the 10 hearth in Washington (Table 5), was almost certainly William James of Washington Hall, whose great grandfather, also William James the Bishop of Durham, had bought the manor in 1613. However the younger William died in 1662, the first year of the tax, implying the records had not been updated by 1666, as his heirs were his sisters.

There were 5 female paying householders, and one non-payer.

In Harraton (Table 6) the owner with the largest dwelling was Sir John Jackson of Harraton Hall then where Lambton Castle is today (not to be confused with Harraton Outside Hall, that was built where the modern village of Lambton is located). He had taken possession in 1655 when he married Susan, nee Grey, the widow of Sir John Hedworth of the family that had owned the estate for generations- see Robert Surtees, The History and Antiquities of the County Palatine of Durham: Volume 2, Chester Ward 1820.

A later marriage settlement brought the Hall into the adjoining Lambton estate.

Eight of the non-payer households were headed by a woman, 5 of whom were widows.

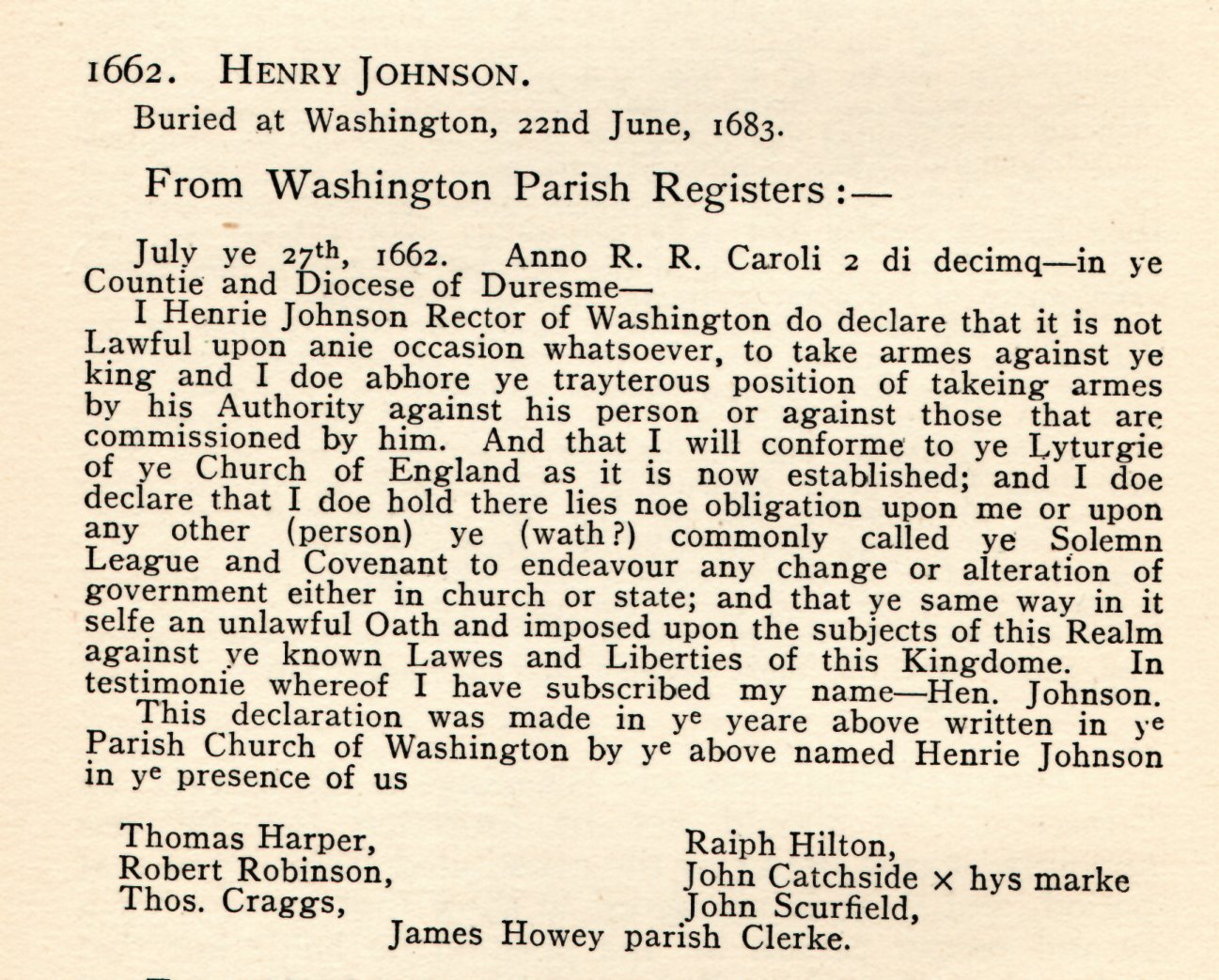

Seven prominent Usworth and Washington residents had witnessed a declaration by the Rev. Henry Johnson, the Rector of Holy Trinity when he took up his post in 1662. See the image below reproduced from Fred Hill, History of Washington Parish Church, 1929.

Those from Usworth were John Catchside (3 hearths) and Robert Robinson (1). There were also Harper and Hilton families with taxable hearths.

John (Jno) Scurfield from Washington witnessed the Rector’s declaration. The James Hovey in the non-payers list could be the parish clerk, James Howey.

The 1674 Returns

Unfortunately not so many of the 1674 returns have survived.

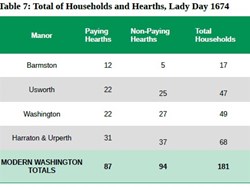

Recorded households were 181 in 1674, 46 (34%) more than in 1666. The increase was likely due to under-recording earlier and the inclusion of Urperth with Harraton, so households in the latter manor leapt from 38 to 68. These additions suggest the population in Washington and Harraton was closer to 1,000 in this period.

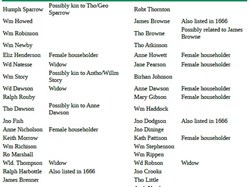

Unfortunately the only surviving list of names is the 47 non-paying Harraton householders.

Interestingly, in 1674 John Hedworth, the son of Sir John and Susan of Harraton, married Anne James, the daughter of William James of Washington, all referred to above. He might have appeared in the lost list of payers.

Conclusion

The hearth tax records of 1666 and 1674 provide a rare glimpse into the social and economic fabric of Washington and Harraton in the 17th century. They reveal a predominantly rural community, modest in wealth compared to the county average, but with a handful of substantial estates. For genealogists and local historians, the named householders are invaluable, linking families such as the Lawsons, Jameses, Marleys, and Wylams to an earlier history of Washington.